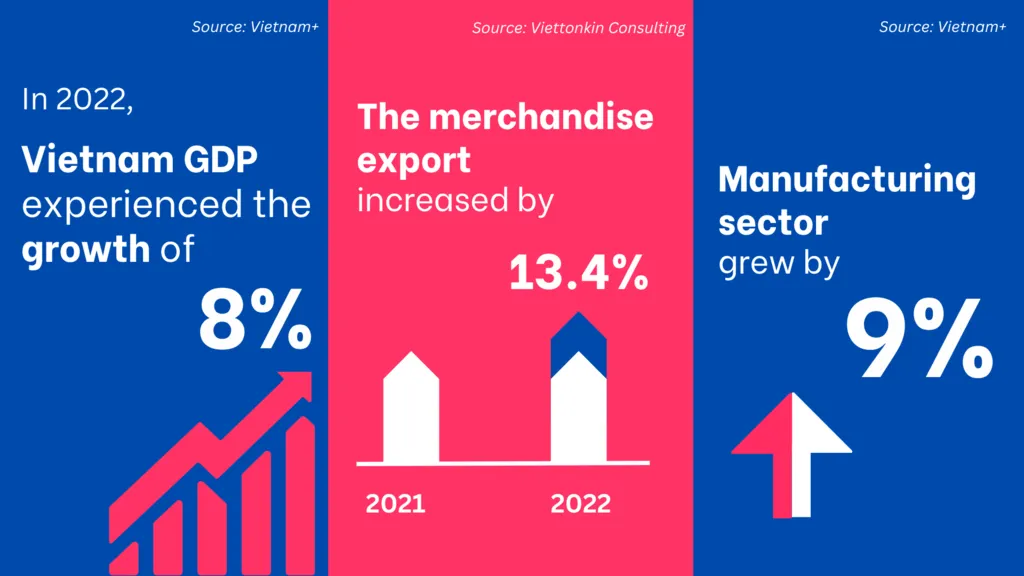

Vietnam is no longer just a low-cost manufacturing hub. With rising investment, technology adoption, and workforce development, the Vietnam manufacturing sector evolution is well underway. The country is shifting toward high-value production, aiming to compete with more developed regional players.

In March 2025, the manufacturing and processing sector grew by 9.5%, contributing 7.9 percentage points to the country's overall industrial growth. From January to April, Vietnam’s industrial production index rose 8.4% year-on-year, with manufacturing and processing up 10.1%. These figures show not only post-pandemic resilience but real momentum. Let's take a closer look!

Vietnam Manufacturing Sector Evolution Fuels GDP and Employment

Manufacturing is now a core pillar of Vietnam’s economy. In Q1 2025, the sector added 2.44 percentage points to GDP growth. Processing and manufacturing alone saw a 9.28% increase, underscoring their central role in national development.

The strength of this sector is also reflected in job creation. Manufacturing employment rose by 5.5% year-on-year as of April 2025. As Vietnam advances into high-value industries, demand for skilled labor continues to grow.

Attracting Foreign Investment and Advanced Manufacturing

Vietnam is actively shaping its industrial future. In just the first four months of 2025, it attracted $8.37 billion in foreign direct investment (FDI) in manufacturing, accounting for 70% of total FDI. This shows strong global investor confidence in Vietnam’s direction.

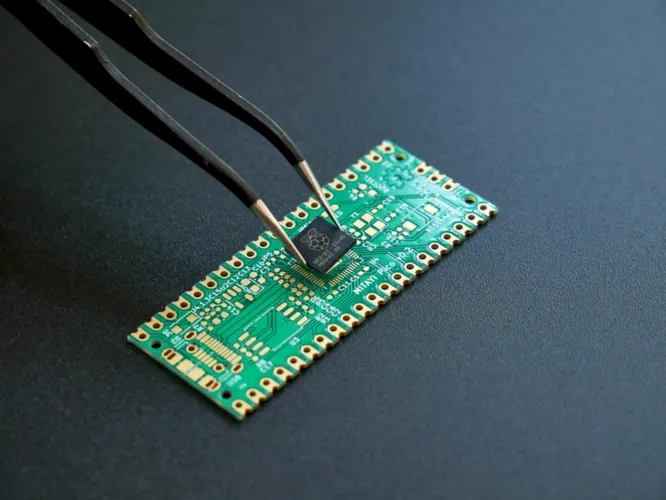

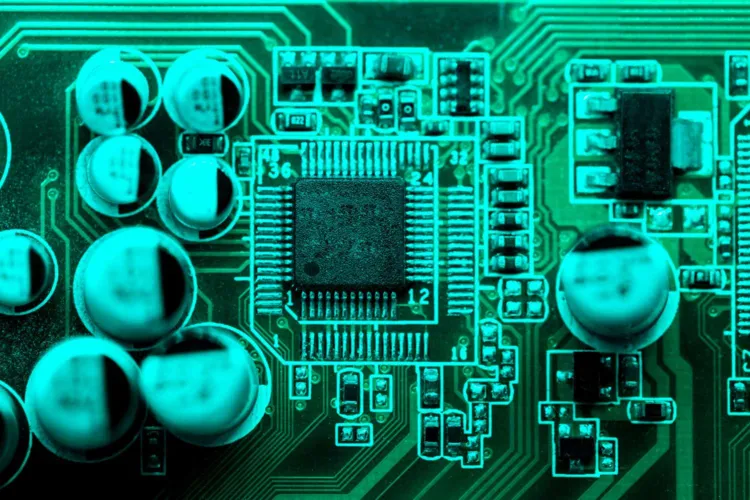

The government is incentivizing high-tech manufacturing, offering corporate tax breaks and developing specialized industrial zones. These zones are tailored for advanced sectors like electronics, automotive, and semiconductors, designed to host both global leaders and emerging players.

Read Also: Vietnam Smart Manufacturing Gains Momentum

Upgrading Infrastructure for Global Competitiveness Through Vietnam Manufacturing Sector Evolution

Infrastructure is another key area of transformation. Vietnam is investing in high-speed rail, smart ports, and logistics networks to reduce bottlenecks and support more complex supply chains. Better infrastructure not only boosts exports but also allows just-in-time manufacturing and faster market delivery.

These upgrades are critical as Vietnam aims to integrate deeper into global supply chains and offer alternatives to China for many multinational corporations.

Read Also: Vietnam Manufacturing Supply Chain Shifts: Global Role

Technology and Workforce: The Future of Manufacturing

The country’s embrace of Industry 4.0 is fueling this evolution. Automation, robotics, and AI are being adopted across key sectors. In textiles, for example, smart systems now track production and detect defects in real time. In electronics and auto manufacturing, robotic arms and digital twins are improving precision and efficiency.

To support this shift, Vietnam is building a more skilled and digitally capable workforce. Government-backed initiatives are pushing for smart factories, digital supply chain platforms, and AI training programs.

This alignment of tech investment and human capital is positioning Vietnam not just as a competitive manufacturer but as a regional innovation partner.

Conclusion: Vietnam Manufacturing Sector Evolution

The Vietnam manufacturing sector evolution is no longer a future goal but a present reality. With 10.1% growth in early 2025, strong FDI inflows, and a commitment to innovation and skilled labor, Vietnam is clearly moving up the value chain. Its transformation is a blueprint for emerging economies looking to shift from low-cost production to high-value, tech-driven manufacturing. For Vietnam, the path forward is clear—and it leads straight into the global future of industry.

Read Also: Breaking Down Vietnam Manufacturing Sector Trends in 2025