Smart farming Vietnam is entering a decisive and exciting phase. If you follow global trade news, you know that the pressure is on. New EU rules about deforestation and carbon are forcing major players in the coffee and shrimp sectors to act fast. It is no longer just about growing good crops; it is about proving where they came from. Without solid proof of sustainable sourcing, access to profitable European markets is at risk. That is why the sector is racing to adopt technology that tracks products, proves compliance, and protects exports.

The Technology Push Behind Smart Farming Vietnam

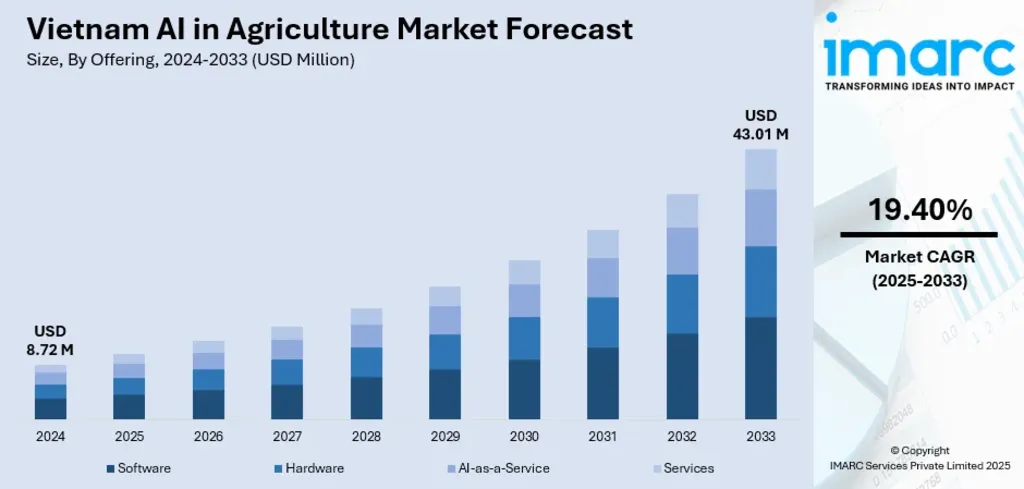

It is amazing to see how much money is moving into this space. The smart farming sector in Vietnam has already attracted more than $2 billion in investment. We are talking about AI tools, IoT sensors, and real-time monitoring networks that are changing life on the ground.

The results speak for themselves. Across nearly 295,000 hectares, farmers have managed to cut water use by 30% while boosting yields by 25%. This shift affects over 250,000 farmers. Even better, AI is reshaping how people work and earn. In key crops like coffee, rice, and durian, these high-tech solutions have reduced labor needs by a massive 75% and raised farmer income by 19%. With 115 agritech startups and over 80% rural fiber optic coverage, the data is flowing as fast as the water.

Why Traceability Is Now Non-Negotiable

This is where things get serious. EU deforestation rules now demand that exporters prove their products did not come from illegally cleared land. For smart farming in Vietnam, this has triggered a rush toward satellite monitoring and blockchain.

Today, satellite platforms are tracking over 34,000 GPS locations tied specifically to coffee farms. AI systems are now detecting deforestation with 93% accuracy. This isn't just cool tech; it is a survival tool that allows exporters to meet strict documentation standards. Add blockchain to the mix, and you get a "farm-to-table" record of every step. These systems align with national goals and bring much-needed transparency to the entire value chain.

Read Also: Why New Vietnam Trade Forecast Revision Sparks Debate

The Rise of "Farm-to-Fork" in Smart Farming Vietnam

The market is clearly shouting for full "farm-to-fork" solutions. Exporters want a single system that connects everyone—farmers, processors, and buyers. It is no surprise that blockchain platforms offering this are seeing huge uptake within the smart farming ecosystem in Vietnam.

The financial backing is there, too. Some providers have secured $70 million in Series A funding, while others have distributed over $30 million in loans to farmers. Astonishingly, these platforms report 100% loan repayment. This shows deep trust and rapid adoption. For tech providers, this is a critical moment. Exporters are done testing; they are buying systems that safeguard their future.

Read Also: Big Money Flows In After Vietnam's Emerging Market Upgrade

Smart Farming Vietnam Shows A Strategic Moment for Investors

Vietnam’s agriculture sector is a powerhouse, contributing nearly 12% to the GDP and employing almost 14 million people. But the game has changed. Feasibility isn't just about yield anymore; it is about carbon data and proof of sustainability.

In this shifting environment, Smart farming Vietnam represents both a challenge and a massive opportunity. Companies seeking deeper insight into this agri-tech transformation should explore advisory and market research services from Market Research Vietnam by Eurogroup Consulting. With 40 years of distinguished experience and a strong focus on market research in the region, Eurogroup Consulting is the essential partner for firms navigating Vietnam’s rapidly evolving agricultural and regulatory landscape.