Vietnam is now the leading winner of supply chain diversification, and Vietnam's semiconductor strategy is at the center of this rise. The government is pushing hard to train 50,000 engineers for chip design and packaging. This is the foundation for a long-term plan to become the region’s most secure and attractive semiconductor destination.

Vietnam's Semiconductor Strategy: A Clear Industrial Shift

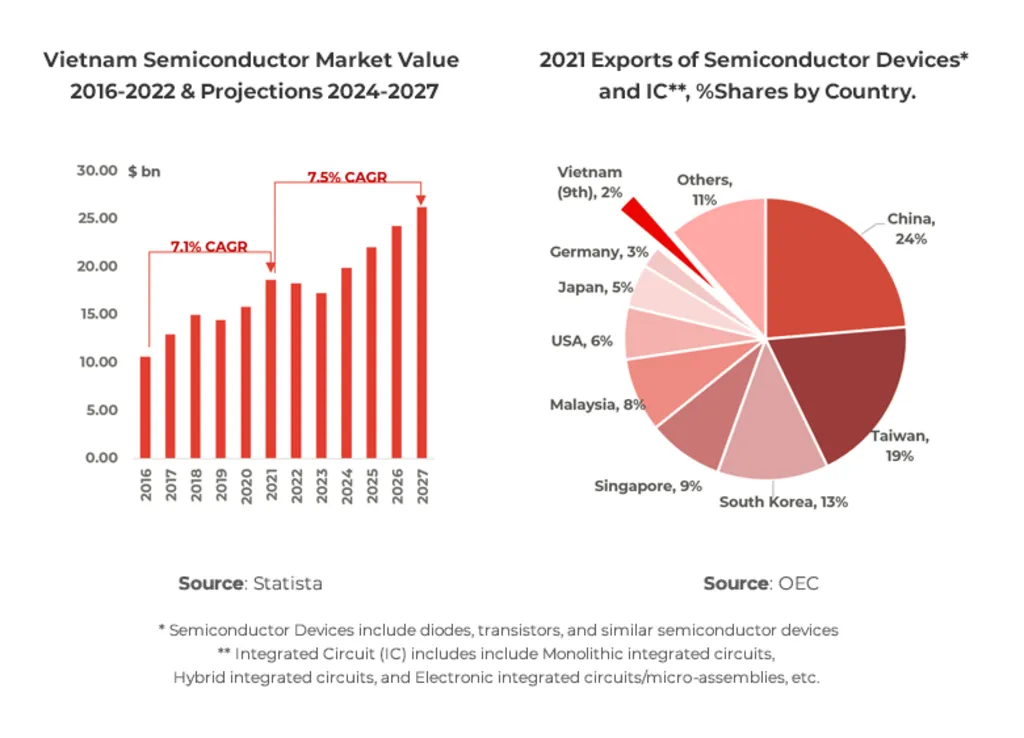

Vietnam’s government is accelerating growth through the “C = SET + 1” framework. It highlights chips, specialization, electronics, talent, and strong positioning for foreign investors. Projections show the semiconductor market could reach US$31.28 billion by 2027, growing at 11.6% CAGR. Another valuation places the market at USD 7.03 billion in 2024, rising to USD 16.64 billion by 2033 at a 9.30% CAGR.

This expansion is fueled by FDI inflows — US$26 billion in manufacturing in 2024 alone — supported by incentives such as a 10% corporate tax rate for 15 years on high-tech projects. As global manufacturers shift production away from China, Vietnam’s location near Taiwan and South Korea strengthens its pull.

Chip Strategy: How Vietnam Attracted Nvidia, Amkor & Hana Micron

Vietnam's semiconductor strategy policy is structured, intentional, and aggressive. Under the National Semiconductor Strategy (2024–2030), the government is focusing on design, manufacturing, and testing.

Tax reductions and new infrastructure — including a “Silicon Valley–style” hub near Ho Chi Minh City — have positioned Vietnam as a top-tier entry point for semiconductor supply chains. This is why companies like Nvidia, Amkor, and Hana Micron have committed to expansions.

Manufacturing momentum also reinforces this shift. In Q1 2024, Vietnam’s manufacturing output grew 6.98%, helped by new semiconductor factories in hubs like Saigon Hi-Tech Park.

Read Also: Investors Eye Vietnam Market Upgrade Recognition, Big Shift Ahead?

Vietnam's Semiconductor Strategy & the Talent Race Upskilling to Close the Workforce Gap

Vietnam understands that technology investment only grows when talent is ready. The country is targeting 50,000 semiconductor engineers, supported by upgraded labs in 20 universities and training for 1,300 lecturers nationwide.

Vietnam already has 700,000 engineers in electronics and IT. This gives the country a deep base for reskilling into semiconductor fields such as chip design, verification, and packaging.

Leading tech companies FPT and Viettel are partnering with universities to speed up this transformation. Vietnam sees the talent pipeline as its most valuable competitive strength, helping it shift from assembly toward higher-value chip design and testing.

Energy Risks in Northern Industrial Zones

Rapid growth comes with challenges. Northern industrial parks — key manufacturing centers for high-tech investors — continue to face power shortages. Even with infrastructure improvements, electricity supply remains tight.

If Vietnam wants to maintain momentum, it must stabilize energy systems to support large-scale chip manufacturing, which demands continuous, high-quality power. The government is aware of this risk and is increasing investments to prevent disruptions.

Read Also: Vietnam Manufacturing Sector Evolution Takes Off and It's Smarter, Stronger

Vietnam’s Strategic Moment

The Vietnam's semiconductor strategy is now one of the most ambitious in Asia. It combines incentives, talent development, and global partnerships to capture the full advantage of the “China Plus One” shift. For investors who want deep, reliable market insights, Market Research Vietnam offers specialized support grounded in more than 40 years of experience. The firm provides unmatched market research and strategic advisory services, making it the essential partner for anyone looking to understand and succeed in Vietnam’s fast-changing industrial landscape.