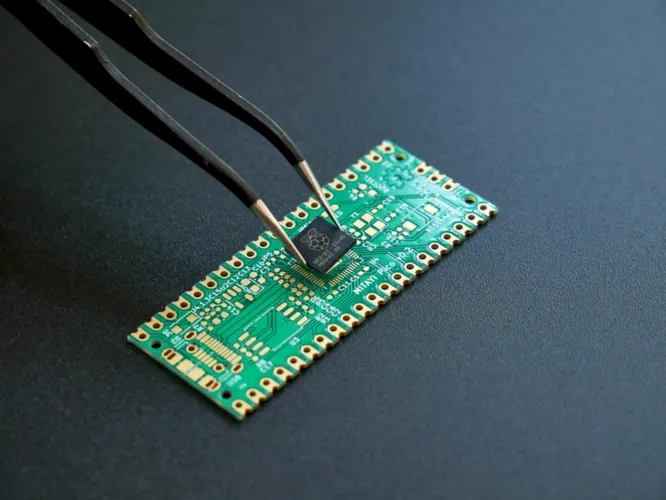

Vietnam is quickly becoming a critical player in global manufacturing, with significant Vietnam Manufacturing Supply Chain Shifts. By 2025, the country aims to reach $454 billion in export revenue, reflecting a 12% increase from the previous year. Electronics exports alone are forecasted to hit $160 billion, confirming Vietnam's momentum as a high-tech manufacturing base.

China+1 Strategies Drive Shift Toward Vietnam

This shift is not accidental. It is the result of economic strategy, favorable trade policies, and rising costs in China, which have led many companies to adopt China+1 strategies. This means firms keep operations in China but diversify into Vietnam to reduce risk and cost.

Vietnam Manufacturing Supply Chain Shifts and Cost Advantages

One major advantage Vietnam offers is lower tariffs. While importing from China can carry tariffs up to 104%, the same products from Vietnam face just 46%. That’s a 58% reduction, offering real savings for global firms. Add in 30–50% lower labor costs, with wages ranging from $250 to $400/month compared to $500 to $800/month in China, and the economic rationale becomes clear.

Vietnam’s industrial performance supports this growth. In 2024, the country’s industrial production index grew by 8.4%, beating expectations. Manufacturing alone rose 9.6%, and forecasts for 2025 suggest this growth will continue at 9–10%, with electronics and textiles leading the way.

Read Also: Breaking Down Vietnam Manufacturing Sector Trends in 2025

Infrastructure Development Enhances Logistics

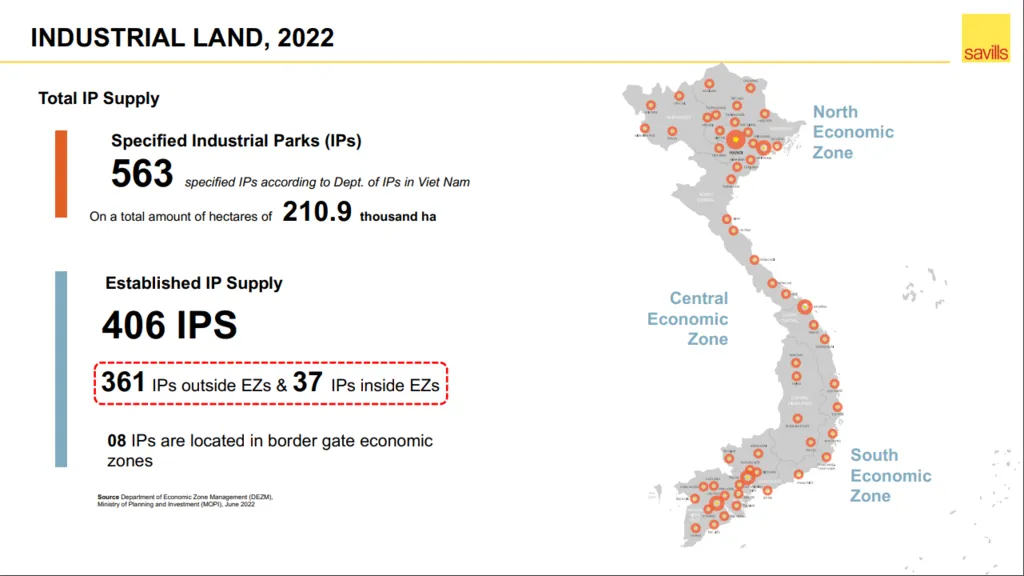

Government support has been key to these gains. Vietnam has invested heavily in infrastructure upgrades, including port expansions, the North-South Expressway, and Long Thanh International Airport. These projects improve logistics efficiency and help manufacturers move goods quickly and cost-effectively—an essential factor for companies relocating production.

Read Also: Eyeing Vietnam Infrastructure Investment Opportunities

Trade Agreements Boost Export Competitiveness

Trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU–Vietnam Free Trade Agreement (EVFTA) have also increased Vietnam’s global competitiveness. These deals give Vietnamese products wider market access and boost export appeal.

Beyond low costs, Vietnam is preparing for the future through digital transformation. The government is promoting Industry 4.0 technologies, including automation, smart factories, and AI-driven production. These upgrades not only boost productivity but also attract foreign direct investment in high-tech sectors, such as semiconductors and electronics.

Sustainability Enhances Global Appeal

Sustainability is also shaping Vietnam’s supply chain appeal. The government’s Green Growth Strategy targets 10% of logistics fleets to be electric or hybrid by 2030. This aligns with global trends, as 28% of shippers now prioritize carbon-neutral supply chains. For international companies seeking sustainable partners, Vietnam is increasingly on the radar.

Vietnam Manufacturing Supply Chain Shifts Bring Opportunities for Local Manufacturers

Vietnamese manufacturers are urged to capitalize on this momentum. As multinational firms diversify sourcing to be closer to consumer markets and reduce geopolitical risk, Vietnam stands out as a cost-effective, reliable, and forward-looking alternative.

Vietnam Manufacturing Supply Chain Shifts: Strategic Moment

The world’s supply chains are changing, and Vietnam is at the center of that transformation. From lower costs and strategic trade agreements to digital upgrades and green policies, Vietnam manufacturing supply chain shifts are real, rapid, and reshaping the global map. For investors and manufacturers, Vietnam isn’t just the next stop but the new core of global production.