Vietnam’s trade momentum remains strong, but new projections show that the regional outlook is shifting. The latest Vietnam Trade Forecast Revision comes as both the World Bank and the Asian Development Bank (ADB) lower their expectations for Southeast Asia’s overall performance in 2025.

Despite the region’s resilience, challenges such as global demand weakness, trade-policy uncertainty, and new tariff risks have cooled optimism across Southeast Asia. For Vietnam, the story is mixed, where trade figures continue to impress, but growth expectations have been adjusted downward amid global turbulence.

Vietnam Trade Forecast Revision: Trade Still Outperforms

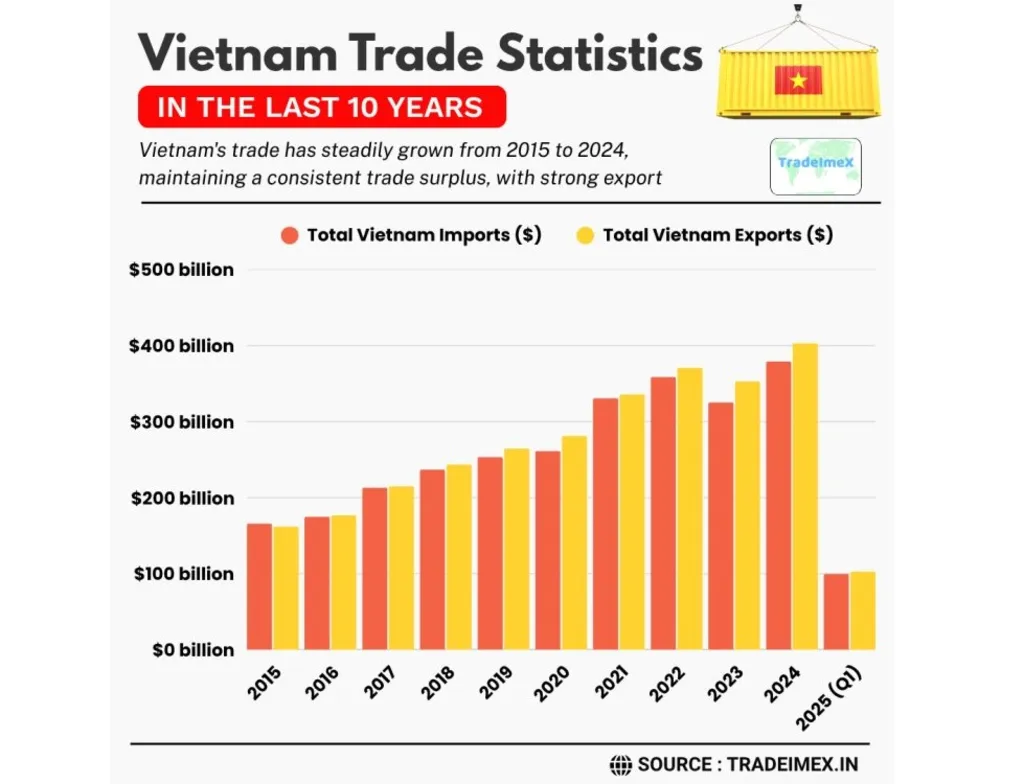

Vietnam’s total merchandise trade in 2024 reached an estimated USD 786.29 billion, marking a robust expansion in both exports and imports. Exports surged 14.3% year-on-year to USD 405.53 billion, while imports climbed 16.7% to USD 380.76 billion. This produced a trade surplus of USD 24.77 billion, underscoring the country’s strong export-led model.

Momentum carried into early 2025. In the first quarter alone, trade turnover grew 13.7% year-on-year to USD 202.52 billion, supported by exports worth USD 102.84 billion and a trade surplus of USD 3.16 billion.

Government planners are aiming for a 12% growth in export-import value for 2025, which could bring the annual trade surplus close to USD 30 billion. These numbers reinforce Vietnam’s position as one of Southeast Asia’s most dynamic trading economies.

Read Also: Vietnam Cross-Border E-commerce Explosion: SMEs Driving Southeast Asia’s Online Export Boom

ADB and World Bank Lower Regional Forecasts

The Asian Development Bank’s latest update paints a softer picture for Southeast Asia as a whole. The region’s 2025 growth outlook has been lowered, reflecting the impact of weaker global demand and rising external shocks.

For Vietnam, the ADB sees moderating growth despite continued strength in manufacturing and exports. The bank highlighted Vietnam’s “resilience amid risk,” noting that trade tensions and supply-chain disruptions could temper short-term gains.

The World Bank echoed this view, cutting its 2025 growth forecast for Vietnam to 6.6%, down from 6.8% in March. This figure also falls below the government’s target of 8.3%-8.5%, showing a cautious tone from international institutions. The revision was linked to slowing export orders and uncertainty caused by new U.S. tariffs—a potential drag on key sectors such as electronics and textiles.

Read Also: Vietnam EV Battery Export Strategy Powers Global EV Future

Read Also: Vietnam Industry & Tech M&A Surge Sees Mega-Deals in August

Mixed Views: Confidence from Standard Chartered

Not all institutions share the same cautious stance. Standard Chartered recently raised its 2025 GDP forecast for Vietnam to 7.5%, citing robust trade data and stronger manufacturing recovery. The bank pointed to a remarkable 66.2% year-on-year surge in electronics exports in September 2025, evidence of Vietnam’s deeper integration in global supply chains.

This contrast between forecasts underscores a clear theme—Vietnam’s fundamentals remain solid, even as short-term risks cloud the picture. Global demand, tariff shifts, and regional supply bottlenecks will continue to shape performance in the coming year.

Regional Role and the Path Ahead for Vietnam Trade Forecast Revision

The Vietnam Trade Forecast Revision ultimately reflects a market caught between optimism and caution. Vietnam’s ability to sustain growth amid policy shifts and external shocks will define its next phase. For companies and investors looking to navigate this fast-changing environment, expert insights and strategy are essential. Market Research Vietnam, a global consulting firm, helps organizations understand market trends, manage risks, and capture growth opportunities across Southeast Asia. To learn more about how to leverage these insights for your business, contact Market Research Vietnam for tailored guidance and support.