Vietnam has reached a major milestone. FTSE Russell has officially upgraded the country to emerging market status, marking a turning point in its financial journey. This Vietnam's Emerging Market Upgrade move signals growing confidence in Vietnam’s economy and opens the door for billions of dollars in new investment.

A Wave of New Capital Expected with Vietnam's Emerging Market Upgrade

FTSE Russell estimates that Vietnam could attract around US$6 billion in capital inflows from passive index funds replicating the FTSE Emerging Market Index. This is not just a technical change, but a vote of trust from global investors.

The World Bank expects even more movement. It projects short-term inflows of about US$5 billion around the time of the upgrade and long-term inflows reaching US$25 billion by 2030. Vietnam’s financial markets are already showing momentum. The VN-Index climbed from 1,100 points in April 2025 to nearly 1,700 points by October 2025—a 50% surge that made it the best-performing market in Southeast Asia that year.

This sharp rise shows growing optimism and trust in Vietnam’s business climate. The upgrade has acted as both a cause and a catalyst, reinforcing investor enthusiasm.

Strong Liquidity Supports Growth

Market liquidity in Vietnam's Emerging Market Upgrade remains solid, giving investors confidence in their ability to enter and exit positions smoothly. In July 2025, daily trading turnover hit VND 34,993 billion (about US$1.32 billion), and the Ho Chi Minh City Stock Exchange reached VND 78.2 trillion (US$2.9 billion) in trading value by early August 2025.

These numbers highlight a robust market foundation that can absorb large investment flows without major disruption. Liquidity like this is one reason why Vietnam was ready for its FTSE upgrade.

Global Investors Already Paying Attention, Thanks to Vietnam's Emerging Market Upgrade

Investor interest in Vietnam is not new. HSBC forecasts that capital inflows could range from US$3.4 billion (active funds) to US$10.4 billion (including passive funds). This shows that both short-term and strategic investors see strong opportunities.

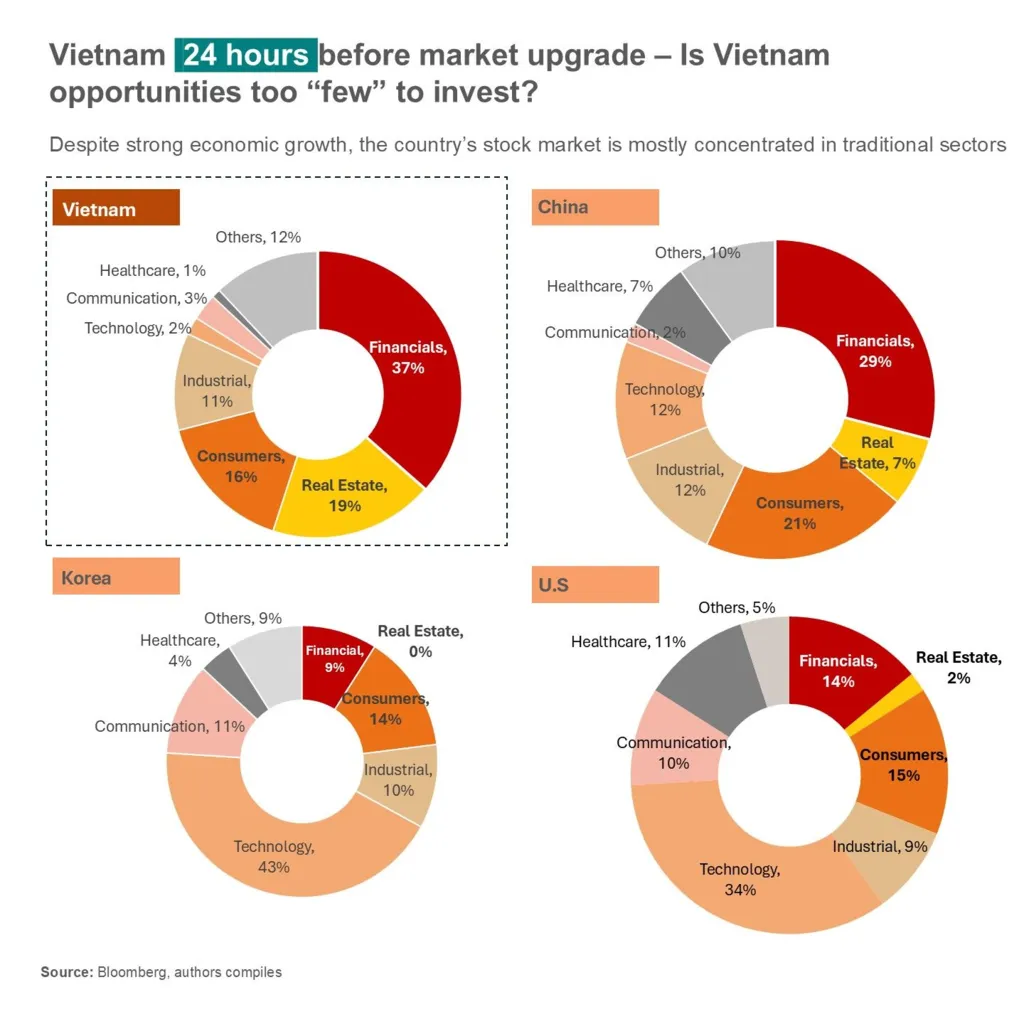

Currently, 38% of Asia-focused funds and 30% of global emerging market funds already hold Vietnamese equities. These figures confirm that Vietnam is already on the radar of major institutional investors, even before the upgrade’s full effects are felt.

Broader Economic Impact

The upgrade does more than lift the stock market—it strengthens Vietnam’s image as a rising global player. The World Bank and analysts agree that increased investment could drive expansion in technology and export sectors, two key pillars of Vietnam’s future growth.

Read Also: Vietnam Industry & Tech M&A Surge Sees Mega-Deals in August

As new funds flow into these areas, the country could see faster innovation, more jobs, and a stronger link to global supply chains. Vietnam’s transformation from a frontier market to an emerging one reflects years of steady progress and policy reform aimed at improving transparency and market access.

Vietnam's Emerging Market Upgrade: A Future Fueled by Confidence

Becoming part of the FTSE Emerging Market Index means Vietnam will now account for around 0.5% of the index. While this share may seem small, it places the country firmly among peers like Thailand and Malaysia—an important symbolic and practical step forward.

Vietnam's Emerging Market Upgrade marks the beginning of a new era. It’s not only about statistics or index weightings; it’s about recognition of Vietnam’s potential as a regional growth leader. The strong inflows, market gains, and investor confidence show that the country’s progress is both real and sustainable. For organizations and investors seeking guidance on how to navigate this new landscape or capitalize on Vietnam’s expanding opportunities, Market Research Vietnam offers deep expertise and tailored support. To learn how your business can benefit from Vietnam’s upgrade, contact Market Research Vietnam today.