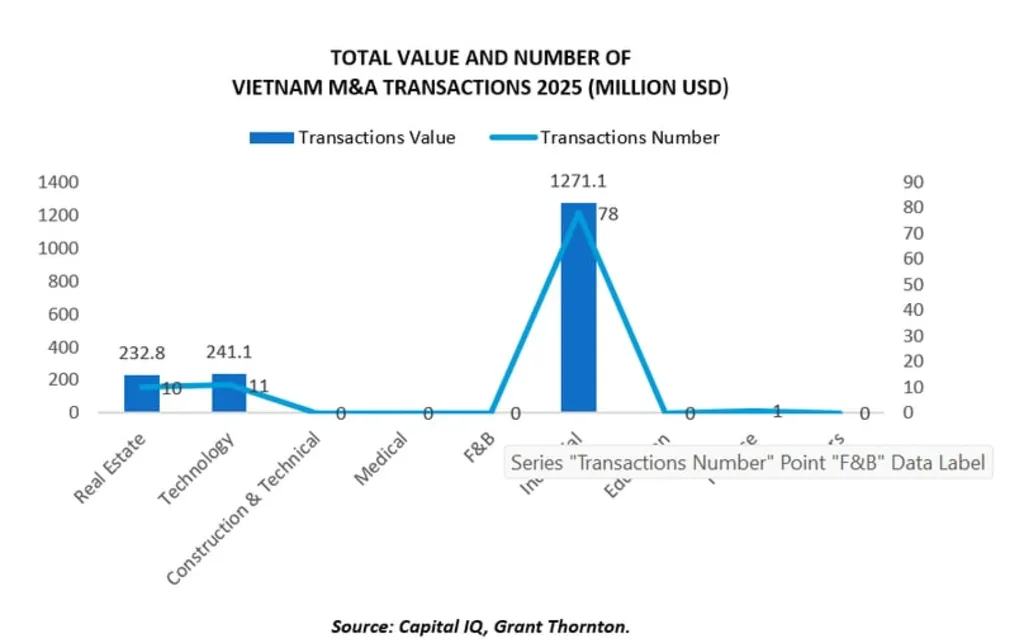

Vietnam’s mergers and acquisitions (M&A) market is showing clear signs of recovery. After a slowdown in 2024, the country is experiencing a sharp rebound in deal activity. August 2025 alone saw 18 transactions worth about US$2.23 billion, dominated by real estate, industrials, and technology. This marks the Vietnam Industry & Tech M&A Surge, with one of the strongest months for Vietnam’s dealmaking in recent years. Moreover, it highlights renewed confidence from both domestic and foreign investors.

Vietnam Industry & Tech M&A Surge: A Strong Rebound After a Difficult Year

The rebound in 2025 is striking because the previous year was weak. In 2024, Vietnam’s M&A market value dropped 30.9% compared to 2023. But reforms improving transparency, combined with market resilience, set the stage for a comeback. By July 2025, 34 deals totaling nearly US$786 million had already been completed, signaling that appetite for acquisitions was returning.

By August, the momentum had shifted sharply upward, and the month’s US$2.23 billion deal value underlined investor confidence in Vietnam’s economic fundamentals.

Real Estate Dominates Deal Flow

Real estate continues to be the backbone of Vietnam’s M&A activity. In the first quarter of 2025, the sector accounted for 44% of total deal value. This strength is closely tied to the 2024 Land Law reforms, which increased market transparency and provided clarity for both domestic and international buyers.

Industrial real estate has been especially active. Since 2018, the supply of ready-built factories and warehouses in Vietnam has doubled, with occupancy rates holding above 80%. This strong demand for logistics and manufacturing space makes industrial property a natural target for acquisitions, fueling M&A interest from global players seeking supply chain diversification.

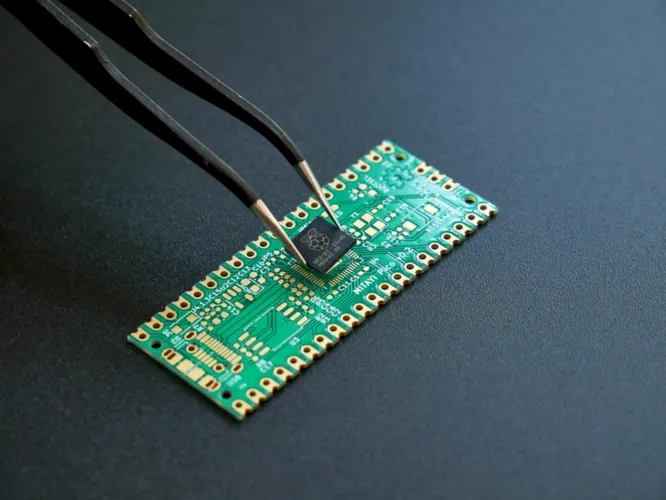

Technology Moves Into the Spotlight

While real estate leads in value, technology is becoming an increasingly important driver of dealmaking. The sector’s share of M&A rose from 2% in 2024 to 5% in Q1 2025, reflecting investor interest in Vietnam’s growing tech ecosystem.

Semiconductors, artificial intelligence (AI), and e-commerce are at the center of this shift. Notable deals include GS Microelectronics acquiring Sinble Technology Vietnam and AI Hay securing US$10 million in Series A funding to scale AI tools. These examples demonstrate how both foreign investors and local startups are shaping the country’s digital future.

Read Also: Vietnam Digital Banking Adoption Sparks Inclusion in Daily Life

Industrials Benefit From Shifting Supply Chains

The industrial sector also saw significant M&A activity, boosted by Vietnam’s position in global manufacturing networks. Companies looking to diversify production away from China are targeting Vietnam’s industrial base. The continued development of logistics, energy, and manufacturing facilities makes the sector attractive for strategic acquisitions.

The strong performance in August indicates that industrial deals are not a short-term trend but part of a longer cycle of supply chain realignment in the region.

Read Also: The Forces Behind Vietnam Organic Market Expansion to Top $3B by 2033

What the Vietnam Industry & Tech M&A Surge Means for Investors

The Vietnam Industry & Tech M&A Surge reflects a market in transition. Real estate remains dominant, but industrials and technology are rising as powerful growth engines. The combination of regulatory reform, resilient economic fundamentals, and global supply chain shifts is creating an attractive environment for dealmaking.

For foreign investors, this means opportunities in high-demand sectors such as logistics, industrial real estate, AI, and semiconductors. For domestic players, it signals the need to adapt quickly to more competitive, diversified deal activity.

Vietnam Industry & Tech M&A Surge: Looking Ahead

The surge in August suggests that Vietnam’s M&A market is firmly entering a recovery phase. If momentum continues, 2025 could reverse much of the decline seen in 2024 and put Vietnam back on track as one of Southeast Asia’s most dynamic investment destinations.

By diversifying beyond real estate into technology and industrials, Vietnam Industry & Tech M&A Surge is seeing a more balanced and resilient M&A market. The deals of August 2025 show that investors see long-term potential, and are willing to commit billions to secure it.