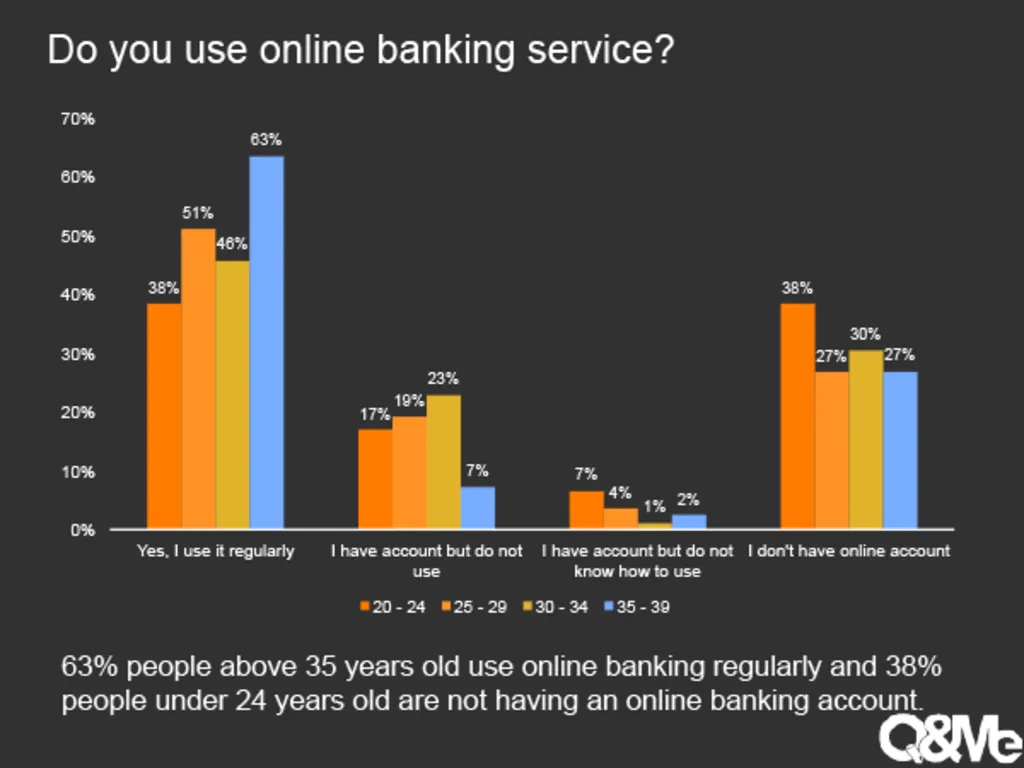

Vietnam is undergoing a digital banking transformation. As of early 2025, 87% of adults hold payment accounts, and at many credit institutions, over 95% of transactions are processed digitally. This shows how deeply Vietnam digital banking adoption has taken root in daily life.

The rise isn’t just in account ownership. Mobile banking app usage jumped 20% year-on-year in Q4 2024, thanks to widespread smartphone access and better internet infrastructure. Non-cash payment transactions surged by nearly 50% compared to the previous year, while payments via mobile channels climbed by 61.14%. These are clear signs that consumers prefer speed, convenience, and control over traditional cash-based systems.

From ATMs to Apps: The Shift in Vietnam Digital Banking Adoption

The numbers tell a story of rapid evolution. The National Payment Corporation of Vietnam (NAPAS) handled 9.56 billion transactions in 2024, up 30% from the previous year. At the same time, ATM usage is dropping fast. Transaction volume at ATMs fell 19.5%, now making up just 2.63% of NAPAS system transactions.

This shift marks more than just a tech upgrade. It’s a cultural change in how Vietnamese people manage their money. Convenience and trust in digital systems are replacing the old habits of visiting branches or withdrawing cash.

Read Also: Rapid Vietnam Digital Transformation Explained

More Digital Means More Financial Activity

There’s more to this shift than technology. Digital banking users in Vietnam are 1.3 times more likely to buy financial products, and they own 1.6 times more products than those who stick to offline channels. This means digital adoption isn’t just about easier payments. In fact, it leads to greater financial engagement and inclusion.

Much of this is driven by trust. Research shows that perceived usefulness, institutional trust, and technological reliability are key to encouraging digital banking use. As confidence in digital platforms grows, so does their influence on financial behavior.

Read Also: What's Waiting for Vietnam E-commerce Market Expansion?

Fintech Growth and Innovation in Vietnam Digital Banking Adoption

The fintech scene is thriving. Between 2015 and 2021, the number of fintech companies in Vietnam grew from 39 to over 154, with 70% being startups. These new players bring fresh solutions to digital payments, lending, and money management—helping reach people traditional banks often miss.

Banks are also doing their part. They’ve invested heavily in AI, blockchain, and biometric tech. AI, in particular, is boosting fraud detection and personalizing customer service, making banking smarter and more secure. This innovation loop keeps users engaged and drives further adoption.

Government Push Accelerates Digital Banking Growth

Vietnam’s government has played a pivotal role in driving digital banking adoption through progressive policies and infrastructure investments. The State Bank of Vietnam’s (SBV) Digital Transformation Plan (2025-2030) aims to have 70% of adults using digital banking by 2030, supported by initiatives like:

- National QR Code Standard (VNQR), enabling seamless cross-bank payments

- Open Banking Framework, allowing fintechs and banks to share customer data (with consent) for better financial products

- Sandbox Regulation, encouraging pilot testing of blockchain-based payment solutions

Vietnam Digital Banking Adoption: A New Financial Era

The pace of Vietnam digital banking adoption is accelerating. With 95% of transactions already digital at many institutions, and with mobile use and fintech innovation rising, Vietnam is becoming a model for digital finance in the region. As technology and trust deepen, the way people spend, save, and invest in Vietnam is changing for good. It’s not just about going digital, but also about empowering more people with better financial tools.