Vietnam is becoming one of the fastest-growing digital economies in Southeast Asia. Strong consumer demand, rising smartphone use, and improved logistics are driving a new era of online shopping. This Vietnam E-Commerce Surge reflects how quickly the market is scaling up and reshaping retail patterns.

Rapid Growth and Market Outlook

Vietnam’s e-commerce sector is on track to reach USD 45 billion by 2027 and nearly USD 49.9 billion by 2028, growing at a 35% CAGR. These figures show that online shopping is not just a short-term trend but a fundamental shift in how Vietnamese consumers buy goods and services.

Forecasts for 2025 alone highlight the pace of expansion. Market analysts estimate the sector will generate USD 30 billion in retail revenue, while the Vietnam E-Business Index (EBI) puts the market size in the range of USD 25-32 billion, with annual growth of 18-20%.

Read Also: The New Wave of Vietnam Food Services Market Trends

Vietnam E-Commerce Surge: Platforms Driving Expansion

The first half of 2025 demonstrated this momentum. Sales on the country’s four leading platforms — Shopee, Lazada, Tiki, and TikTok Shop — reached VND 202.3 trillion (about USD 7.8 billion). The combined GMV of VND 222.1 trillion grew 23% year-on-year, far outpacing the overall retail industry’s 9.3% growth.

Among platforms, TikTok Shop stood out with a 148% YoY GMV increase, signaling the rapid rise of social commerce. While Shopee maintains its lead, TikTok Shop is quickly catching up, driven by younger, mobile-first consumers.

Read Also: What's Waiting for Vietnam E-commerce Market Expansion?

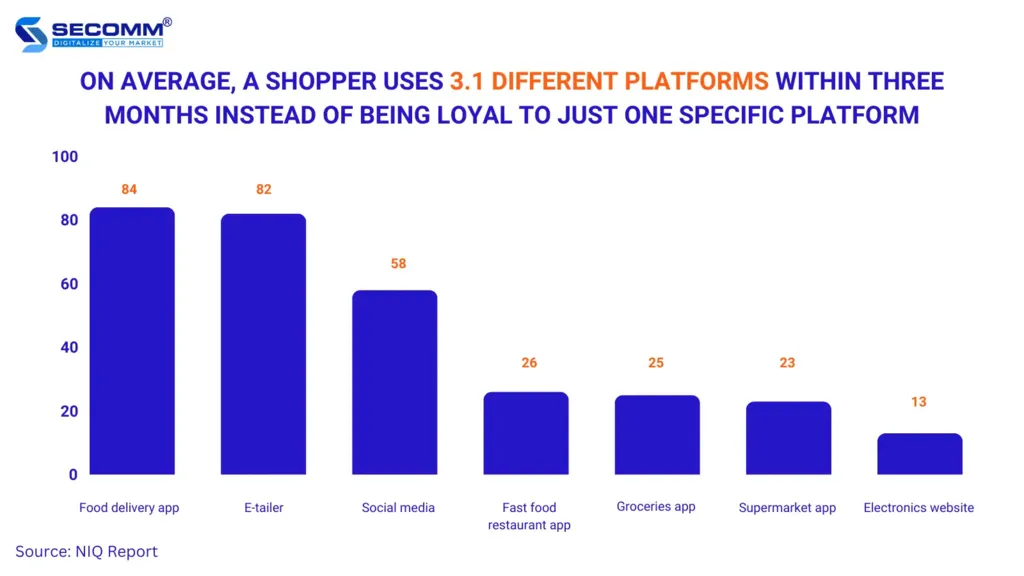

Shifts in Consumer Behavior

Consumer habits are also evolving. Online shopping revenue in Q2 2025 reached nearly USD 4.6 billion, representing 15% quarter-on-quarter growth. This surge is fueled by deeper internet penetration, greater smartphone adoption, and the appeal of “shoppertainment” — the blend of shopping and entertainment.

Interestingly, while the number of shops on these platforms decreased, the average revenue per shop increased 27.6%. This suggests the market is maturing, with consumers favoring larger sellers and genuine stores over smaller, less reliable operators.

Basket sizes are also increasing, showing that customers are buying more per transaction. Together, these shifts reflect a move toward quality, trust, and convenience in Vietnam’s online retail space.

Infrastructure and Logistics Investments in Vietnam E-Commerce Surge

Behind the scenes, logistics and infrastructure investments are supporting this e-commerce boom. As order volumes rise, companies are expanding fulfillment centers, last-mile delivery networks, and cross-border shipping capabilities. These investments ensure that delivery times shrink even as the number of online shoppers grows.

Improved digital payments also play a key role. With more consumers using mobile wallets and online banking, transactions are becoming faster, safer, and more seamless. This trend is particularly important for mobile-first shoppers, who increasingly expect convenience from browsing to checkout.

The Digital Economy’s Broader Impact

The Vietnam E-Commerce Surge is not only transforming retail but also fueling the broader digital economy. By 2025, online platforms could capture a market size comparable to traditional retail growth, positioning e-commerce as a core driver of GDP expansion. The integration of technology, logistics, and consumer demand highlights Vietnam’s readiness to compete in the regional digital economy. If current trends hold, the country’s e-commerce sector could emerge as a model for other Southeast Asian markets.

FAQs

1. How big is Vietnam’s e-commerce market expected to get?

It is forecasted to reach USD 45 billion by 2027 and nearly USD 49.9 billion by 2028.

2. Which platforms dominate Vietnam’s e-commerce sector?

Shopee, Lazada, Tiki, and TikTok Shop are the leading players.

3. What is driving the Vietnam E-Commerce Surge?

Rising smartphone use, shoppertainment trends, and stronger logistics networks are fueling growth.

4. How is TikTok Shop performing in Vietnam?

It recorded a 148% year-on-year GMV growth in the first half of 2025.

5. How are consumer behaviors changing?

Shoppers are buying more per basket, focusing on trusted sellers, and spending more on each transaction.