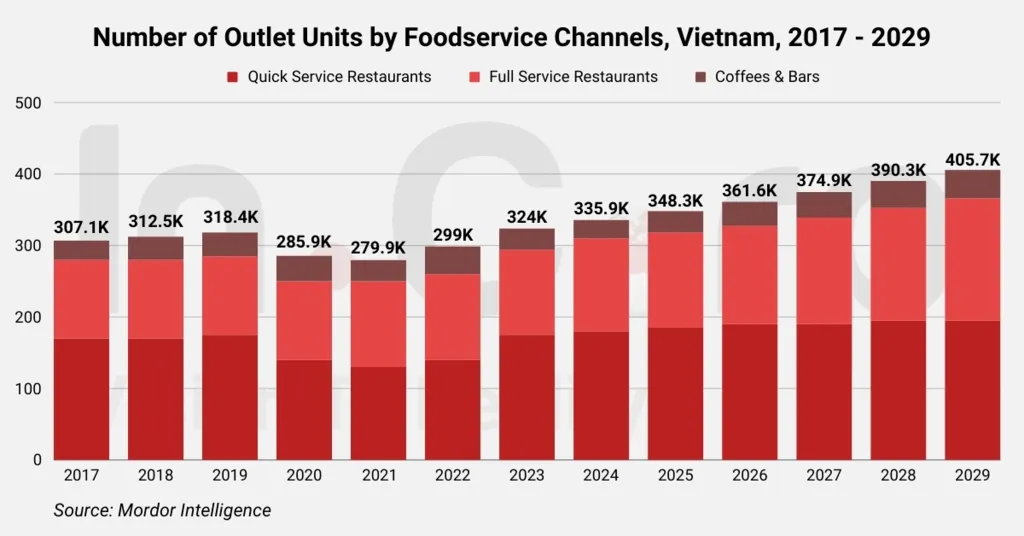

Vietnam’s food services sector is growing fast. In 2023, the market was valued at USD 21.62 billion. By 2029, it's projected to hit USD 40.45 billion, growing at a strong CAGR of 11.01%. This rapid rise highlights the country’s growing demand for convenient dining and quality food experiences. The Vietnam Food Services Market Trends show not just growth in size, but a shift in how people eat, order, and spend. Ready to find out more about this topic?

Digital Transformation Is Reshaping the Industry

More food businesses are going online. By 2022, 53% of food establishments in Vietnam had an online presence. This shift is powered by changing consumer habits and easier access to digital payment methods.

Food delivery services like GrabFood, GoFood, and Baemin have also boosted the rise of cloud kitchens. These are kitchens built only for delivery orders—no dining area, just fast, efficient service. The cloud kitchen market is growing at a CAGR of 3.72%, showing steady demand for digital-first food options.

Read Also: Rapid Vietnam Digital Transformation Explained

Online Food Delivery Keeps Surging in Vietnam Food Services Market Trends

In 2023, online food delivery revenue in Vietnam reached USD 1.93 billion. The trend reflects the growing appetite for convenience. As people turn to apps for meals, restaurants must adapt by offering delivery, pickup, and mobile-friendly menus. GrabFood dominates the market, holding over 50% of the delivery sector, followed by ShopeeFood and Baemin.

To stay competitive, restaurants are expanding their digital offerings, including:

- Hybrid dining models (dine-in + delivery)

- Subscription-based meal plans (e.g., weekly office lunches)

- AI-driven dynamic pricing (adjusting costs based on demand)

Consumer Preferences by Age and Cuisine

Understanding who eats what is key to success in Vietnam’s food services market. Younger consumers aged 18 to 24 prefer fast food, while those aged 25 to 34 lean toward local eateries and pizza/pasta spots. Asian cuisine leads in popularity, holding over 40% of the cuisine market share. This is partly due to strong tourism from countries like China and South Korea, where travelers seek familiar flavors while visiting Vietnam.

Vietnam Food Services Market Trends Show Strong Growth in the Profit Sector

Beyond restaurants and delivery, Vietnam’s profit sector—which includes all revenue-generating food service operations—is booming. It’s expected to grow from VND 1,370.1 trillion ($56.9 billion) in 2024 to VND 2,125.4 trillion ($82.8 billion) by 2029, at a CAGR of 9.2%. Quick-service restaurants (QSRs) and coffee chains (The Coffee House, Highlands Coffee) are among the fastest-growing segments, catering to both locals and expats. Additionally, fine dining and experiential restaurants are gaining traction, particularly in major cities.

Infrastructure Fuels Vietnam Food Services Market Trends and Expansion

The country’s retail infrastructure supports this growth. With over 1,100 supermarkets and hypermarkets and 10,000+ convenience stores, there are plenty of platforms for food service operators to reach customers across urban and suburban areas.

Read Also: Eyeing Vietnam Infrastructure Investment Opportunities

The Road Ahead

The Vietnam Food Services Market Trends point to a dynamic future. With strong revenue growth, rising digital adoption, and evolving consumer habits, Vietnam offers major opportunities for both local and global food service brands. Companies that respond to digital trends, tailor menus to different age groups, and tap into popular cuisines will have the edge. As the market heads toward USD 40.45 billion by 2029, now is the time to invest, innovate, and grow.