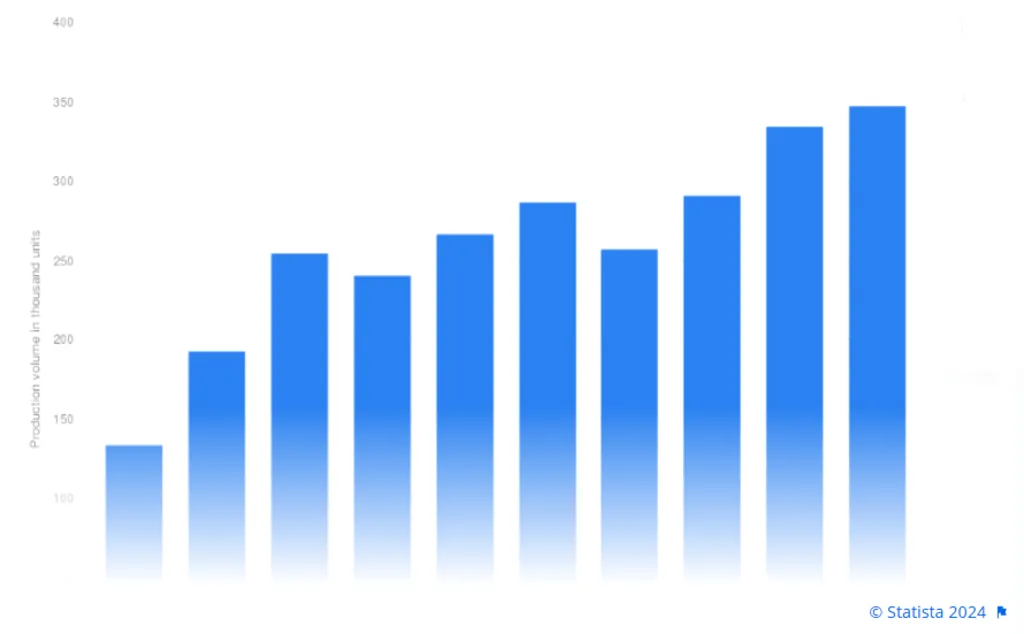

Vietnam’s automotive industry has undergone significant changes over the past decade, marked by fluctuating production volumes, rising consumer demand, and an increasing presence of foreign brands. In 2023, Vietnam’s automobile production volume reached approximately 347.4 thousand units, marking an increase from the previous year. Despite this progress, the industry has faced numerous challenges and opportunities. These key insights are essential for anyone looking to enter or navigate the complexities of the industry. In this article, we present data sourced from Vietnam Mobility Consulting to provide a comprehensive understanding of the market dynamics.

Vietnam’s Rising Car Ownership and Economic Growth

Purchasing a car in Vietnam has historically been seen as a substantial investment. However, economic improvements and a growing middle class have made car ownership more attainable for many Vietnamese. As a result, Vietnam’s automotive market has emerged as one of the fastest-growing in Southeast Asia. While cars are still considered big-ticket items, they are increasingly becoming a common sight on the streets of Vietnamese cities, serving as a primary mode of transportation alongside motorcycles.

Domestic Automobiles Production and Foreign Influence

Since 2020, Vietnam has seen a gradual increase in automobile production to meet domestic demand. However, the local manufacturing sector still relies heavily on imported advanced parts, limiting its production capacity. Consequently, imported cars remain widely popular, despite high import taxes. Japanese and Korean brands, such as Mitsubishi, Hyundai, and Toyota, dominate the market due to their affordability and low maintenance costs. These brands were among the best-selling models in Vietnam in 2023. Additionally, European brands, often viewed as symbols of luxury and prestige, have also gained a niche following among affluent Vietnamese consumers.

Impact of the COVID-19 Pandemic

The automotive market in Vietnam experienced significant disruptions due to the COVID-19 pandemic. The beginning of 2022 marked an economic recovery as lockdown restrictions were lifted, leading to increased interest in purchasing cars. However, global inflation in 2023 led to a reduction in household expenses, causing a notable slump in automobile production and sales after initial signs of recovery in 2022.

The Shift Towards Electric Vehicles

A notable trend in Vietnam’s automotive industry is the growing interest in electric vehicles (EVs). The Vietnamese government has implemented various measures to support EV adoption, including tax rebates, investments in EV infrastructure, and support for local manufacturers. This initiative is part of a broader goal to have one million EVs on Vietnamese roads by 2028. The introduction of VinFast in 2017, Vietnam’s first automobile manufacturer specializing in EVs, has significantly changed the industry’s landscape. VinFast is actively working towards producing made-in-Vietnam electric cars for the global market, contributing to the country’s automotive growth trajectory.

Future Prospects and Opportunities

The fluctuating production volume of automobiles in Vietnam from 2014 to 2023 highlights the industry’s dynamic nature. The continued economic growth, rising middle class, and government support for EVs present significant opportunities. The automotive industry in Vietnam is poised for a promising future, with efforts to boost domestic production and expand into international markets.

Conclusion

Vietnam’s automotive industry has evolved remarkably over the past decade. From the rise in car ownership due to economic growth to the increasing influence of foreign brands and the burgeoning interest in electric vehicles, the market is rich with opportunities. For those involved in or new to the industry, consider investing in a strategic partnership with a reputable Vietnam Mobility Consulting firm to understand the crucial insights needed for navigating market entry and its complexities. The production volume of automobiles in Vietnam from 2014 to 2023 illustrates the industry’s potential and the need for strategic investment to navigate its complexities. With continued efforts and supportive government policies, Vietnam’s automotive industry is on track for a robust recovery and sustained growth in the coming years.