Public-Private Partnerships (PPPs) in Vietnam have become a key driver of infrastructure development, helping the nation tackle its growing infrastructure needs. As one of Asia’s fastest-growing economies, Vietnam faces a significant infrastructure investment gap, projected to reach $102 billion by 2040. The government recognizes that it cannot meet these demands alone and has embraced Public-Private Partnerships Vietnam to attract private investment. By partnering with private firms, Vietnam can boost growth, modernize essential services, and improve socio-economic conditions.

The Evolution of Public-Private Partnerships Vietnam

Vietnam’s PPP journey started in the early 1990s when the government began allowing foreign investment in infrastructure through Build-Operate-Transfer (BOT) contracts. These BOT contracts enabled foreign companies to finance, build, and operate projects for a set period before transferring them back to the government. Decrees in 1993 further refined the framework, allowing 100% foreign investment or joint ventures with Vietnamese partners. The legal framework evolved over the decades, incorporating other PPP forms such as Build-Transfer-Operate (BTO) and Build-Transfer (BT) contracts.

The most significant milestone came in 2021 with the introduction of the Public-Private Partnerships Vietnam Law, which consolidated existing regulations and addressed long-standing concerns of foreign investors. This law ensures clearer legal guidelines and boosts confidence among international stakeholders, signaling the government’s commitment to making PPP projects more commercially viable. Key sectors targeted by this law include transportation, energy, water management, waste treatment, healthcare, and education.

A Surge in Infrastructure Demand

Vietnam’s rapid economic growth has fueled its need for improved infrastructure. As of 2019, the country was investing 6.3% of its GDP in infrastructure projects, well above the regional average of 4.1%. Despite this, the funding gap remains vast, with government spending covering 90% of the costs. This gap highlights the critical role of private capital, especially through PPPs, to finance large-scale projects that the government alone cannot fully fund.

Vietnam’s PPP model has already yielded tangible results. According to the World Bank, since 1990, 147 PPP projects with a total value of $27.8 billion have reached financial closure. A significant portion of these projects has been in the energy sector, helping Vietnam address its rising demand for electricity and other utilities.

Public-Private Partnerships Vietnam projects often focus on sectors vital to national development, such as transportation and energy. For example, the energy sector dominates the country’s PPP landscape, with power generation projects requiring an estimated $133.3 billion by 2030.

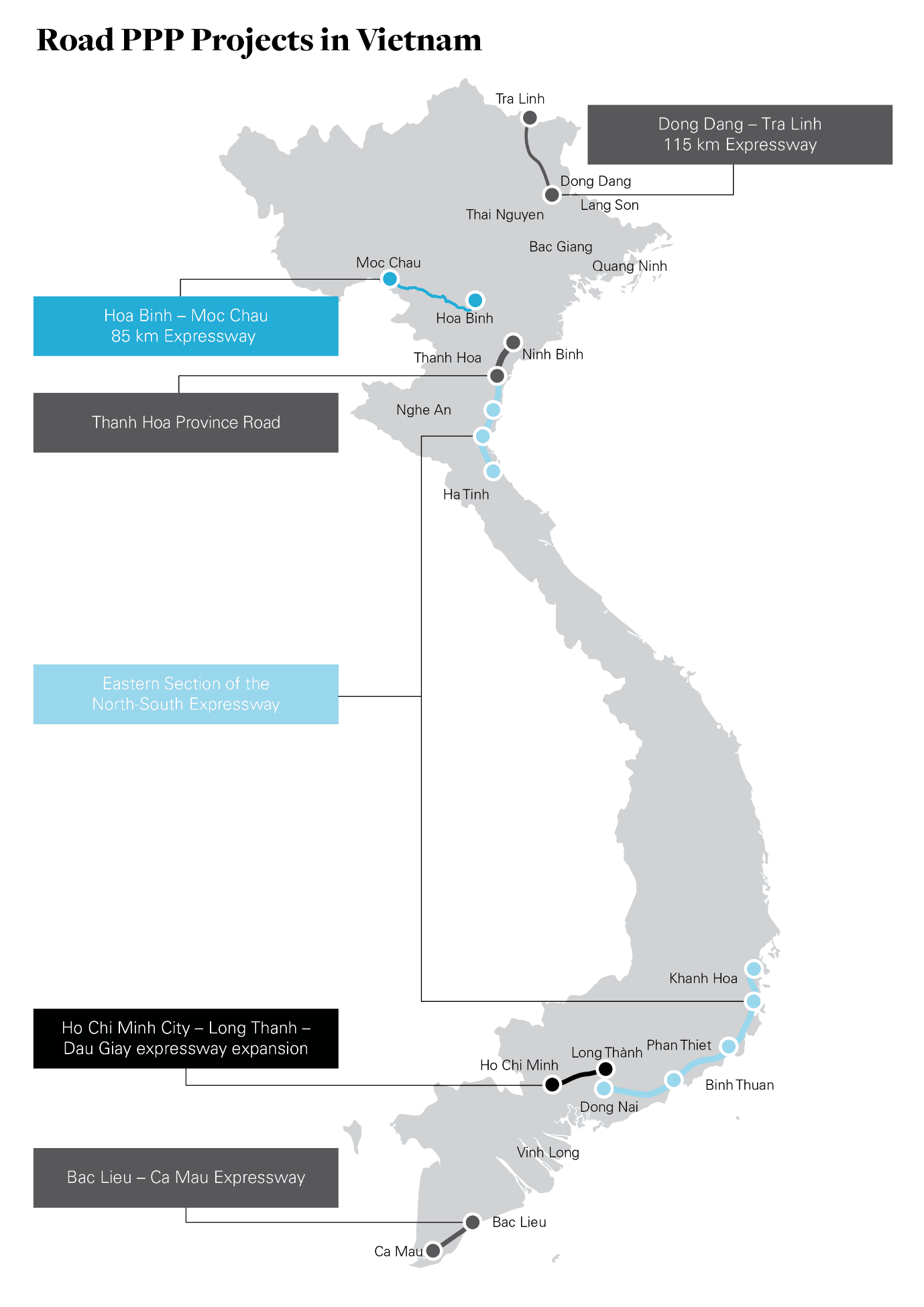

Moreover, the road and transportation sectors continue to attract private investment. The North-South Expressway’s Eastern section is a prime example. Despite initial financing challenges, the government retained several sections of this project under the PPP framework. These projects illustrate the potential of Public-Private Partnerships Vietnam to address the growing infrastructure needs while also providing investment opportunities for private firms.

USAID’s Role in Strengthening PPPs

To enhance the performance and viability of Public-Private Partnerships Vietnam, the U.S. Agency for International Development (USAID) has been providing crucial support. Since 2019, USAID has worked with the National Assembly and the Ministry of Planning and Investment to help draft the PPP Law. Their efforts aim to build a robust PPP environment by facilitating knowledge exchange, technical assistance, and capacity building.

One of USAID’s significant contributions has been its collaboration with the Vietnam Chamber of Commerce and Industry (VCCI). With the help of KPMG, a global professional services firm, USAID and VCCI have built a comprehensive online platform that provides resources to both public and private stakeholders involved in PPP projects. This platform includes toolkits, training materials, and legal documents. It offers critical support for navigating Vietnam’s PPP landscape.

The Future Potential of Public-Private Partnerships Vietnam

Public-Private Partnerships Vietnam are proving to be an indispensable tool in the country’s quest for modernized infrastructure. The government’s commitment to improving the legal framework and facilitating foreign investment, combined with international support from organizations like USAID, has set the stage for more successful PPP ventures. By continuing to attract private capital and collaboration, Vietnam can bridge its infrastructure gap and pave the way for long-term growth and development.