Vietnam’s Public-Private Partnership (PPP) regime has been a significant driving force in the country’s infrastructure development over the past three decades. Initially emerging in the 1990s, PPPs were encouraged as a means to attract foreign capital, with the Build-Operate-Transfer (BOT) model as one of the primary approaches. Through these early projects, Vietnam aimed to leverage foreign investment to address its infrastructure needs. At the same time, the country also wants to enable private companies to manage risks effectively.

The Evolution of Vietnam’s Public-Private Partnership: A Historical Overview

To further encourage PPPs, the Vietnamese government introduced decrees in 1993, allowing BOT projects with full foreign investment. This approach created opportunities for foreign investors to finance, develop, and operate public infrastructure, ultimately transferring ownership back to the government after a specified period.

By the mid-1990s, new Vietnam’s Public-Private Partnership forms such as Build-Transfer-Operate (BTO) and Build-Transfer (BT) expanded the scope of contracts. As a result, it enhances flexibility for both foreign and domestic investors.

In 2021, Vietnam passed the PPP Law, consolidating existing regulations and offering new clarifications on contract terms. While gaps remain, especially in creating a supportive legal environment, this law underscores the government’s commitment to expanding PPP opportunities.

Meeting Growing Infrastructure Needs with Vietnam’s Public-Private Partnership

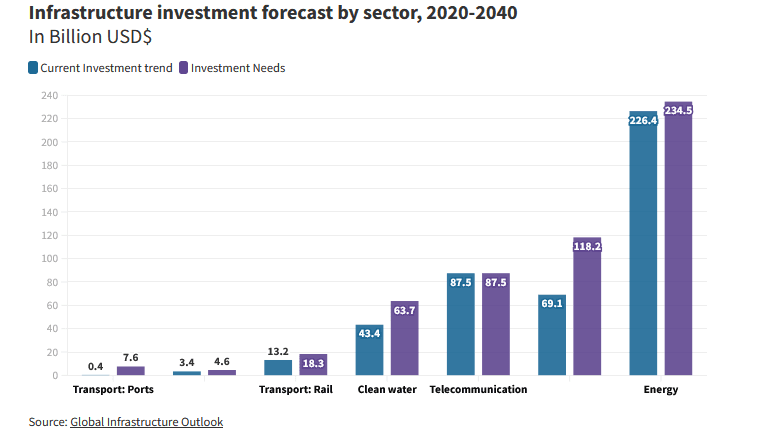

The demand for infrastructure continues to grow rapidly, outpacing what government funding alone can sustain. An estimated $200 billion in infrastructure investment is necessary over the next few years to sustain Vietnam’s growth. Currently, the government funds 90% of infrastructure projects.

Read More: The Key to Infrastructure Development in Vietnam

However, this level of investment is insufficient to meet the rising demand, with a projected investment gap of around $102 billion by 2040. To address this, Vietnam’s Public-Private Partnership projects are seen as a solution, especially in high-demand sectors such as transportation, energy, and water management.

Healthcare and Education PPP Projects

In addition to traditional sectors, new Vietnam’s Public-Private Partnership initiatives include diverse projects in healthcare and education. For example, the healthcare sector is exploring PPPs to improve medical infrastructure and broaden access to essential services. Although few healthcare projects have been approved so far, the government is actively working to adjust regulations to attract more investors.

A recent draft circular, discussed in a workshop in Hanoi, proposes lowering the minimum investment threshold for healthcare PPPs. This is to encourage smaller projects to join the PPP model. With these revisions, healthcare PPPs are expected to gain traction, increasing the private sector’s role in enhancing medical services for Vietnamese citizens.

Crucial PPPs: Transportation and Energy Infrastructure

Transportation and energy projects remain key Vietnam’s Public-Private Partnership areas, requiring minimum investments of around VND 200 billion. This amount is reduced to VND 100 billion in economically disadvantaged regions, ensuring that infrastructure development reaches all parts of the country.

Read More: Vietnam Green Building Trends: A Path to the Greener Future

Similarly, wastewater treatment, clean water supply, and IT infrastructure projects follow this investment structure. By diversifying the focus of PPP projects, Vietnam aims to spread development benefits across various regions, making growth more inclusive.

Challenges Facing Vietnam’s Public-Private Partnership Model

However, challenges remain in creating a pipeline of projects that attract international investors to support Vietnam’s Public-Private Partnership. Complex regulations, overlapping laws, and high procurement costs have made PPP projects difficult to implement. While the PPP Law provides a legal foundation, limited resources and technical expertise within local government agencies hinder the effective management of PPPs. Bottlenecks in the procurement process and high operational risks are further barriers. Consequently, some projects initially structured as PPPs are reverted to traditional procurement methods.

Read More: How to Meet Vietnam Construction Regulations

Vietnam’s Public-Private Partnership program demonstrates the potential of public-private collaborations in driving economic growth. With proper regulatory adjustments and a commitment to transparency, the PPP model holds promise for the country’s future infrastructure needs. As Vietnam continues to refine its PPP framework, it is likely that foreign and domestic investors will find increasingly attractive opportunities. Ultimately, it will transform critical infrastructure across the country.