Vietnam Economy Trends 2024: Manufacturing Sector Growth and Foreign Investment Surge

In the first half of 2024, Vietnam’s economy demonstrates strong potential, with notable growth in the manufacturing sector and a surge in foreign investments. Our Market Research Vietnam Trends Q1 & Q2 2024 data reveals that strategic initiatives and favorable economic policies are driving robust growth, attracting significant global interest. This article explores the key factors fueling these trends and their implications for Vietnam’s future.

Manufacturing Growth: A Pillar of Economic Expansion

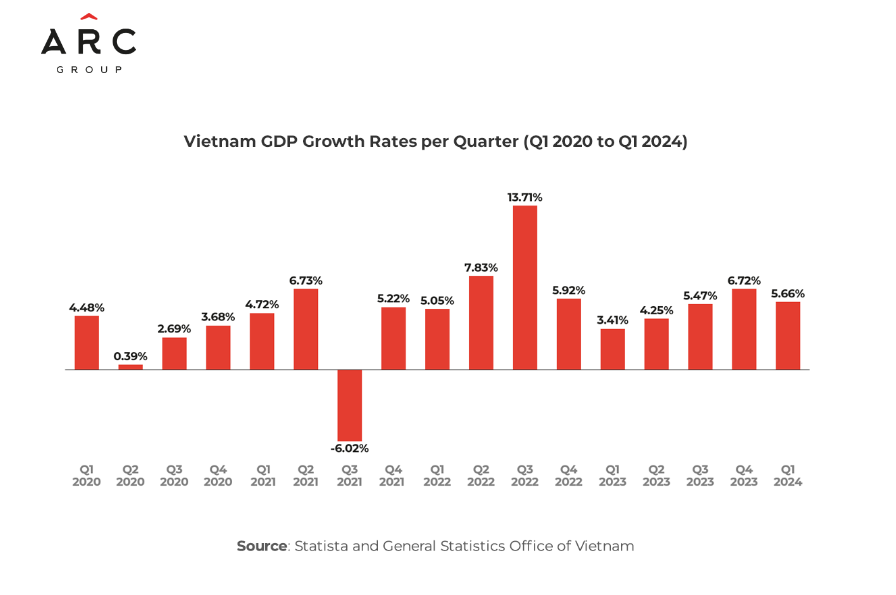

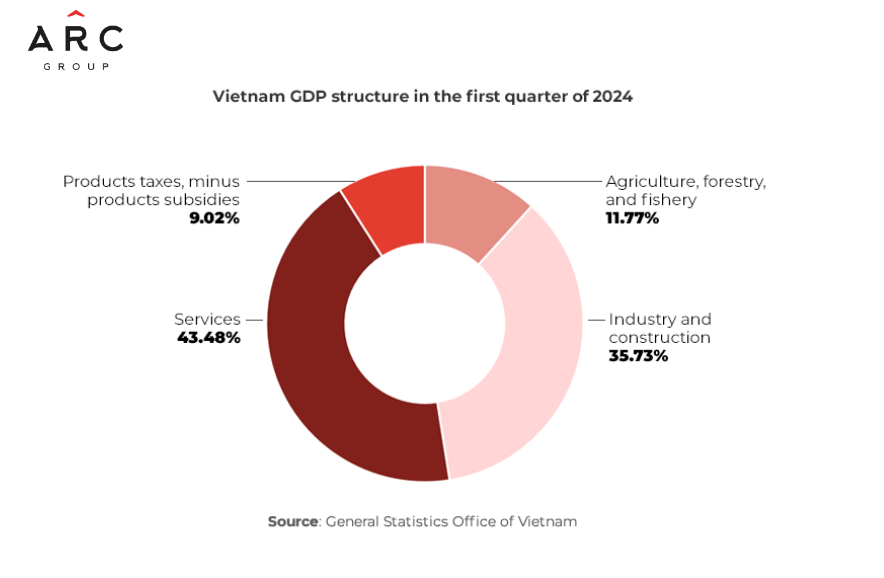

Vietnam’s GDP grew by 5.66% in the first quarter of 2024, largely fueled by the manufacturing industry. While this growth rate is slightly below the previous quarter’s 6.72%, it marks the highest first-quarter expansion since 2020. The manufacturing sector, a cornerstone of Vietnam’s export economy, surged by 6.98%, contributing 1.73 percentage points to the overall growth. This robust expansion is attributed to the strategic relocation of global manufacturing bases from China to Vietnam, leveraging the country’s competitive advantages such as affordable labor, stable political environment, and favorable geographic location.

Public investment policies have played a crucial role in this growth, particularly in infrastructure development, enhancing the operational efficiency of manufacturing plants. Additionally, the processing and manufacturing industries have benefited from the Vietnamese government’s supportive measures, creating a conducive environment for growth.

Foreign Investments: A Testament to Vietnam’s Potential

The first quarter of 2024 saw a significant increase in foreign direct investment (FDI) in Vietnam. Total FDI registered during this period amounted to over $6.17 billion, marking a 13.4% increase compared to the previous year. This surge underscores Vietnam’s growing appeal as a prime destination for global investors.

Significant FDI contributions came from the manufacturing and processing industries, which attracted $3.93 billion, accounting for a large share of the total FDI. Real estate followed closely, with investments doubling to $1.58 billion year-on-year. The substantial interest from foreign investors is a clear indication of confidence in Vietnam’s economic prospects.

Countries like Singapore and Hong Kong were leading sources of FDI, with Singapore alone contributing $2.55 billion, a 51.3% increase from the previous year. This influx highlights the strategic importance of Vietnam in the regional and global supply chains, particularly in electronics and semiconductor manufacturing.

Key Factors Driving Investment and Growth

Several factors are propelling this growth trajectory. Firstly, Vietnam’s young and skilled workforce is a significant draw for foreign investors. The government’s commitment to improving infrastructure and providing investment incentives has also been pivotal.

Furthermore, Vietnam’s strategic location in Southeast Asia, coupled with its stable political environment, makes it an ideal hub for manufacturing and export activities. The country’s robust trade relations with major economies like the United States, South Korea, and Japan further bolster its position.

The government’s proactive stance in attracting investments, especially in high-tech industries like semiconductors, is another crucial factor. Major global corporations such as Intel, Samsung, and Nvidia are expanding their operations in Vietnam, attracted by the favorable investment climate and the potential to integrate into the global semiconductor supply chain.

Outlook for Q2 2024 and Beyond

As Vietnam continues to attract foreign investments and bolster its manufacturing sector, the outlook for the second quarter of 2024 remains positive. Continued government support, coupled with strategic economic policies, is expected to sustain this growth momentum. Our Market Research Vietnam Trends Q1 & Q2 2024 data reveals that the anticipated introduction of new laws governing land use, real estate, and credit institutions by 2025 is expected to further enhance the investment landscape, making Vietnam an even more attractive destination for global investors.

In conclusion, the growth in the manufacturing sector and the surge in foreign investments highlight Vietnam’s robust economic fundamentals and strategic importance in the global supply chain. For businesses and investors, these trends underscore the vast opportunities that Vietnam presents in the coming years.