Vietnam is facing a significant housing crisis, particularly in its major cities, Hanoi and Ho Chi Minh City (HCMC). Despite government efforts to expand Affordable Housing Vietnam, there is still a major gap between demand and supply. This article explores the critical challenges in Vietnam’s affordable housing sector and examines how the government and private developers can work together to address this growing issue. Let’s take a look!

Affordable Housing Vietnam: High Demand, Low Supply

The demand for affordable housing in Vietnam is skyrocketing, especially in large urban centers. According to Nguyễn Trọng Ninh, director of the Housing and Real Estate Market Management Department, Hanoi and HCMC collectively need an additional one million homes to meet the existing demand. However, despite ambitious targets and government intervention, progress has been slow. For instance, social housing projects have only reached 30% of the 2020 target.

Affordability Gap

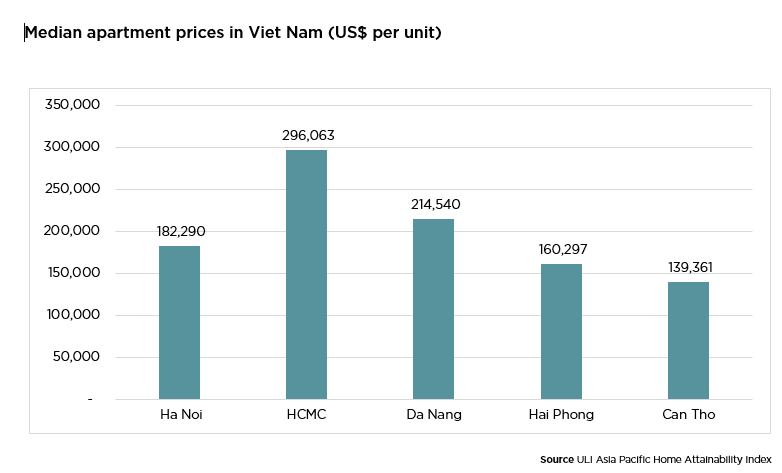

One of the most significant challenges to Affordable Housing Vietnam is the affordability gap. Home prices have outpaced income growth by a significant margin. The Urban Land Institute’s 2023 data reveals that in HCMC, home prices are 32.5 times higher than the average income, and in Da Nang, prices are 26.7 times higher. In contrast, Hanoi shows a slightly lower ratio of 18.3.

This widening gap makes it almost impossible for average-income earners to afford a home. For example, in HCMC, a 65-square-meter apartment should ideally cost about $50,000 to be considered affordable. However, current market prices are over $323,000 for the same unit size . As a result, many middle-class families are priced out of the housing market.

Infrastructure and Satellite Development

While central city areas remain expensive, there are more affordable options in surrounding provinces. These satellite areas are becoming increasingly attractive as Vietnam improves its infrastructure. Roads, highways, and metro systems are shortening travel times to central business districts (CBD). This is making outlying regions like Binh Duong, Dong Nai, and Long An more accessible.

In these regions, homes priced below VND 5 billion make up a significant portion of available stock, compared to a shrinking share in Hanoi and HCMC. Infrastructure developments are playing a vital role in reducing land costs, enabling the construction of Affordable Housing Vietnam on the city’s outskirts.

Government Initiatives for Affordable Housing Vietnam

The Vietnamese government has introduced several measures to stimulate the development of Affordable Housing Vietnam. The VNĐ30 trillion (US$1.22 billion) stimulus package, launched after the 2008 financial crisis, provided home buyers with preferential interest rates. This initiative helped over 56,000 people purchase homes.

More recently, a larger $4.88 billion package aims to build one million social housing units by 2030. However, progress remains slow—only 38,128 units have been completed as of 2023.

Additionally, the government offers incentives for social housing developers, such as low-interest loans and exemptions from land use taxes. Yet, the effectiveness of these initiatives is often limited by bureaucratic challenges and high interest rates on loans, which remain unaffordable for many lower-income families.

Role of Private Developers

Private developers have a crucial role in bridging the affordable housing gap in Vietnam. By partnering with the government, developers can benefit from land tax exemptions and other incentives. As a result, this can make affordable housing projects more financially viable. However, speculation in the housing market by long-term investors often drives up prices, further exacerbating the affordability issue.

Developers are also beginning to focus on smaller, more Affordable Housing Vietnam units. As incomes grow and families accumulate equity, the trend of “ownership progression” may allow more people to move up from starter homes to larger properties over time.

Vietnam’s affordable housing crisis is complex, driven by rising home prices and insufficient supply. While government initiatives and infrastructure improvements offer some relief, collaboration with private developers is essential to meet the growing demand. Addressing the gap in Affordable Housing Vietnam requires long-term strategies. The strategies need to balance economic growth, infrastructure development, and equitable housing policies.